- Established an M&A strategy based on the screening of 100+ acquisition targets. Evaluated and performed commercial due diligence of the market, product offering, customers, and suppliers for four shortlisted targets in Europe.

- Led the fundraising process and secured a successful $10+ million first close for a private equity fund. Responsibilities included defining and communicating the offering to investors, developing investor materials, and supporting negotiations.

- Valued a food processing company using the comparable company and discounted cash flow (DCF) valuation methodologies, achieving a significant net debt adjustment that reduced the purchase price paid by the client.

- Performed commercial due diligence of a chemical company, identifying key risks as well as profit enhancement opportunities, including price increases, expense rationalization, and inorganic growth initiatives.

- Identified and led a working capital reduction of 20%+ for a Nordic services company by renegotiating customer agreements, establishing non-recourse factoring, and improving invoicing procedures.

- Supported one of the largest companies in Sweden, active in the telecom space, with 15 acquisitions, divestitures, and joint ventures across Europe and the US.

- Supported one of the largest companies in Sweden, active in consumer goods, to develop their M&A capability, define M&A strategies, and execute on M&A transactions.

- Developed P&L and cash flow forecasts and conducted a valuation of a discretionary consumer goods company as part of their fundraising. Supported investor reach-out and negotiation and helped secure a multi-million dollar fundraising round.

Focus areas: Initial Public Offerings, M&A (Buy-side), M&A Modeling, M&A (Sell-side), Due Diligence, Private Company Valuation, Private Equity, Fundraising, Cash Flow Calculation, Price Analysis, Cost Benchmarking, Working Capital Management, Corporate Finance, Mergers & Acquisitions (M&A), Acquisition Analysis, Acquisitions, Analysis, Carve-out Planning, Cost Reduction & Optimization, Cross-border M&A, DCF Modeling, DCF Valuation, Free Cash Flow (FCF), NPV, Pricing, Financial Modeling, Forecasting, Revenue & Expense Projections, Investment Return Scenario Analysis, IRR, Cash Flow Modeling, Investments, ROI, Business Planning, Board Presentations, eCommerce, Business Models, Business Plan Consulting

M&A Screening for a Construction Company

M&A Screening for a Construction Company Valuation of a Consumer Goods Company

Valuation of a Consumer Goods Company Working Capital Reduction for Industrial Product Producer

Working Capital Reduction for Industrial Product Producer Valuation of an Industrial Equipment Manufacturer

Valuation of an Industrial Equipment Manufacturer Commercial Due Diligence of B2B Software Provider

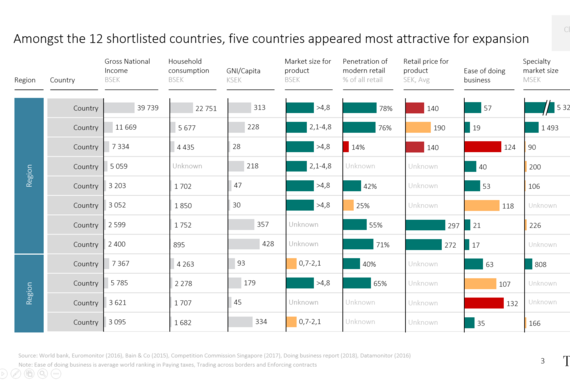

Commercial Due Diligence of B2B Software Provider Organic Expansion Strategy for Consumer Goods Company

Organic Expansion Strategy for Consumer Goods Company